The Core Data Infrastructure for Modern Banking

From raw data to intelligence — unified, traceable, and AI-ready. Built for banks and fintechs that treat data as strategy, not storage.

Why Us

Engineered by experts, trusted by regulators.

We’ve built licensed digital banks, passed audits, and delivered enterprise-grade data infrastructure trusted by global institutions.

Proven architecture

Built on HSBC-grade Common Data Model principles

Unified data model

Integrates all data sources into one framework

Scalable performance

Designed for global scale and real-time processing

Enterprise compliance

SOC 2, PCI DSS, OCIF, MAS, DFSA certified

Regulatory-grade traceability

Full lineage, validation, and audit readiness

AI-ready infrastructure

Optimized for analytics, ML, and automation

Automated reporting

Power BI dashboards with self- service capabilities

Proven in production

Running daily within Arival Bank’s live systems

Who it’s for

Ideal for:

Digital banks building intelligence

Starting Point

Operating with fragmented data sources, legacy analytics tools, and limited visibility into customer behavior across channels.

What You Unlock

A unified Common Data Model that centralizes analytics, delivers real-time insights, and powers AI-driven decisions across all customer journeys.

Legacy institutions upgrading data

Starting Point

Running on outdated systems with siloed databases, slow manual reporting, and inconsistent data accuracy across departments.

What You Unlock

A modernized data architecture with automated pipelines, complete traceability, and enterprise-grade speed for regulatory and business use.

Fintechs scaling rapidly

Starting Point

Relying on multiple APIs, disconnected data streams, and limited scalability for analytics, monitoring, and sustainable growth.

What You Unlock

A cloud-based data warehouse with integrated layers, seamless API connectivity, and built-in compliance ready to scale globally.

Compliance-driven teams and analysts

Starting Point

Managing fragmented reports, manual audits, and constant pressure to maintain transparency across all data systems.

What You Unlock

A standardized, regulator-approved data model with automated reporting, audit trails, and end-to-end data governance for every workflow.

Data Foundation

Structured for clarity, optimized for control.

Layers

Raw, Staging, and Conformed layers create a unified flow from ingestion to insights.

Each layer adds structure, validation, and context for business and compliance use.

Designed for precision.

Integration

Connects all internal and external data sources through one unified pipeline.

Minimizes manual effort while maximizing consistency and data reliability.

Reliable. Consistent. Real time.

Data Model

The Common Data Model standardizes logic across the organization, linking all systems and entities.

It’s the foundation for analytics, automation, and regulatory reporting.

One structure for every system.

Performance

Frequent micro-batch transfers keep systems fast, stable, and scalable under heavy load.

Optimized for efficiency and minimal resource consumption at every stage.

Always on, always efficient.

AI-ready

Data is curated, cleaned, and enriched for advanced analytics and AI-driven insights.

Supports intelligent automation, classification, and private LLM integration.

Smart by default.

Traceability

Every dataset is validated, versioned, and auditable across all transformation steps.

Full lineage and transparency are built directly into the architecture.

Compliant by design.

Security & сompliance

Enterprise-grade trust, regulator-approved.

Our Data Warehouse is built with layered security, global compliance, and continuous monitoring. Every process, from encryption to audits, ensures full data trust and transparency.

Data encryption

All data is encrypted in transit and at rest using advanced algorithms that meet global banking standards and ensure complete protection.

Access control

Granular, role-based permissions manage access across users and systems, maintaining strong security, accountability, and transparency.

Regulatory compliance

Aligned with SOC 2, PCI DSS, OCIF, MAS, and DFSA frameworks to guarantee regulatory readiness and consistent security across regions.

Penetration testing

Regular third-party assessments and monitoring ensure resilience, reliability, and proactive protection against threats.

Data integrity

Automated validation, quality checks, and anomaly detection maintain data accuracy, consistency, and reliability across layers.

Data Architecture

Architected for precision, refined for performance.

A multi-layered architecture that ensures accuracy, lineage, and performance across every stage of data movement.

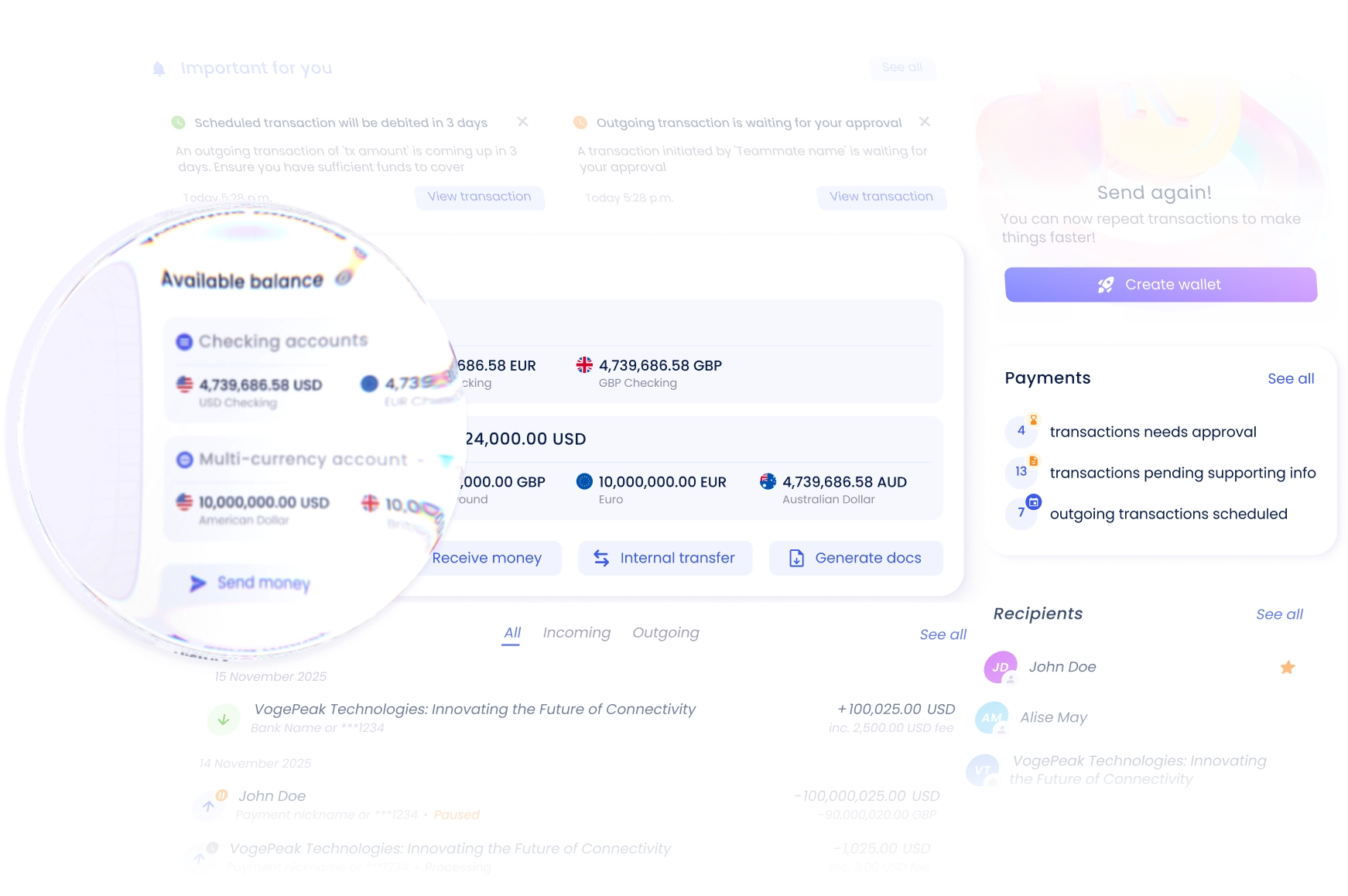

Real case: Arival Bank

Proven in production.

Arival, a fully licensed digital bank, runs on EZ infrastructure. From onboarding to payments, everything works at scale — with modular compliance and global readiness.

Yeidie Ortiz

Chief Executive Officer at Arival Bank

EZ is changing the way fintechs partner with banks — the speed and infrastructure they bring is unmatched.

Go live in 3 months

From idea to production — starting from 3 months.

Whether you're launching a new product or scaling fast, our expert team helps you go live — from strategy to full deployment.

Strategy

Align on goals, markets, and what you're building — we map the fastest path to launch.

Briefing

We dive into your product needs and finalize the feature stack, architecture, and timeline.

Setup

Your environment is provisioned, secured, and tailored — including compliance modules and APIs.

Integration

We run through use cases, compliance flows, and edge cases to ensure readiness.

Testing

We run through use cases, compliance flows, and edge cases to ensure readiness.

Launch

Your product goes live — fully supported, compliant, and ready to scale with confidence.

Your data deserves better infrastructure

Let’s talk about your data journey — and how quickly we can help you unify it.

Contact us!

Contact SalesSkaya, Inc. (Skaya) is a technology and services company, not a bank. Banking services are provided by Skaya's bank partners. EZ, EZ Banking and EZ ID are registered trademarks of Skaya.